Fundamentals in Focus:

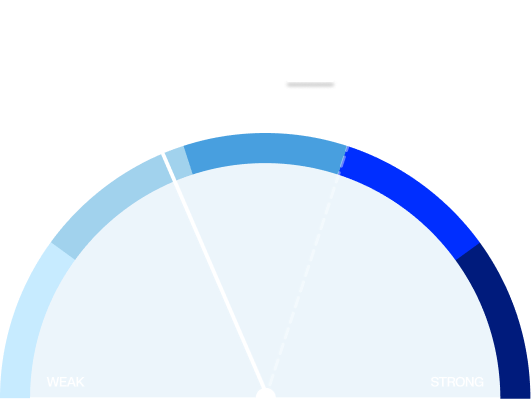

The SSAA Industry Snapshot 2023 explores the strong performance of the self storage sector.

More than 140 new self storage facilities are forecast to come online over the next two to three years, if all projects proceed.

Well established, existing self storage developers continue to grow and develop a high proportion of new supply.

More than 140 new self storage facilities are forecast to come online over the next two to three years, if all projects proceed.

Well established, existing self storage developers continue to grow and develop a high proportion of new supply.